404 - Page not found

Oops, better check that URL.

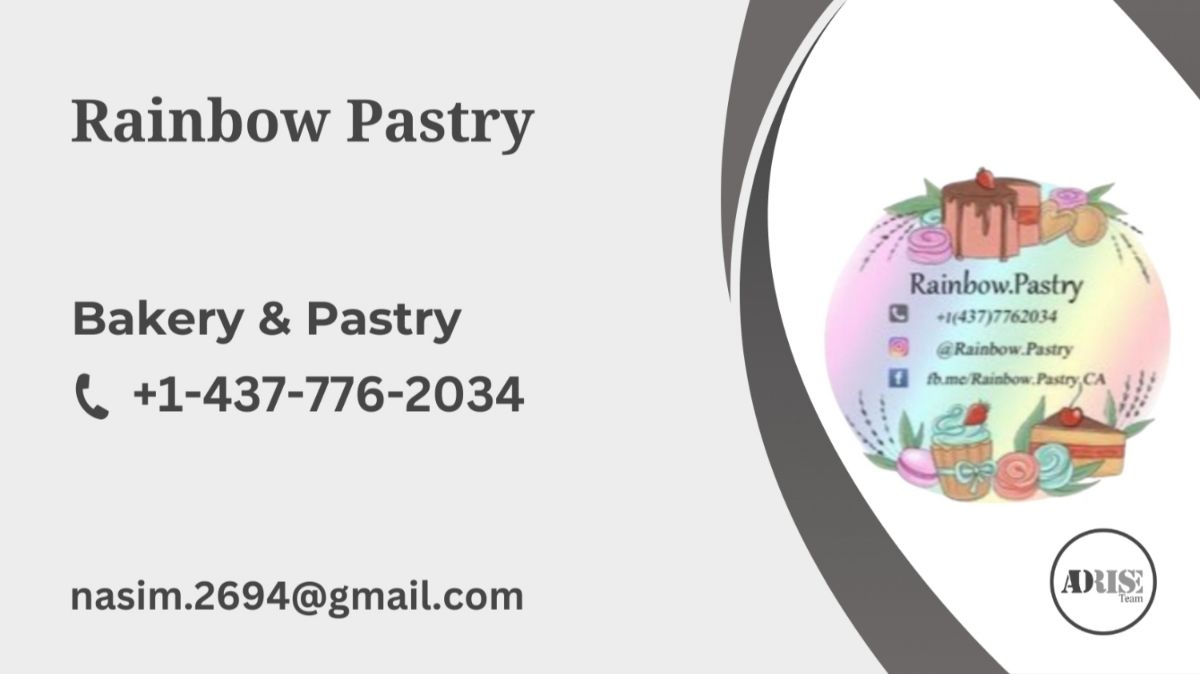

Adrise is an online platform introducing Canadian businesses, while generating leads and interactions between businesses and customers.

Users can access businesses based on its category and city. They can also filter businesses based on ethnicity. Therefore, customers can connect to businesses who speak their language, know their culture, and better understand their needs.

To register your business information and create a webpage for FREE on Adrise website:

1. Sign in with your phone number.

2. Click on “Add a New Business”.